A couple from Hampshire in the United Kingdom, Mark Rowe and his wife Nicola, both aged 54, have been found guilty of orchestrating a complex timeshare scam. The scheme targeted mainly elderly timeshare owners, and investigators estimate that more than 3,000 people lost a combined total of approximately £28.1 million.

Operating under the business name Sell My Timeshare (SMT), the couple promised to help timeshare owners sell their properties or convert them into so-called ‘Monster Credits’, which were claimed to have value for holidays and shopping. Many victims invested around £8,000 each, and some took out loans to participate.

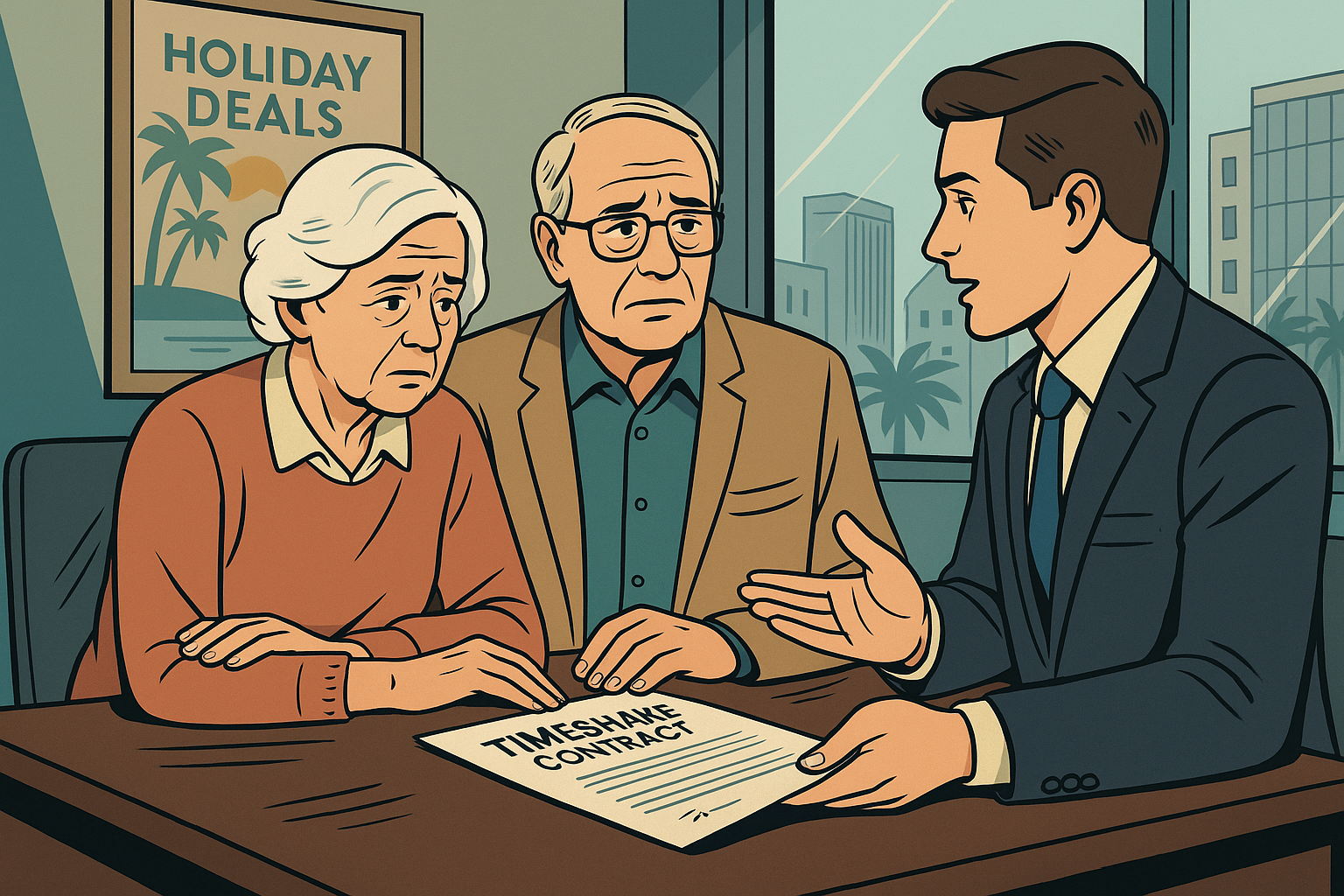

According to investigators, the Rowes used high-pressure sales tactics, including long sessions that lasted up to six hours, placed victims in hotels, created fake virtual offices, and used fake personas to convince owners of the legitimacy of the offer.

The majority of the victims were aged between 60 and 80, with some in their nineties, and the largest individual loss recorded was £80,000. Victims soon discovered that the credits they purchased were worthless and that they remained responsible for timeshare maintenance fees. The deception left many financially exposed and unable to exit the timeshare ownership as promised.

Mark Rowe was sentenced to seven and a half years in prison after being found guilty of conspiracy to defraud. His wife pleaded guilty to money laundering offences and will be sentenced separately. The case was carried out under Operation Destin and resulted in 14 convictions over multiple trials at Southwark Crown Court.

Why timeshare exit offers are high-risk

Timeshare owners often face financial pressures such as annual maintenance fees and declining resale markets. Scammers use this vulnerability by offering relief from obligations or promising large returns from timeshare investments.

By offering complex refund or credit schemes through supposedly trusted brands, fraudsters can defraud large numbers of victims. In this case, the Rowes exploited a well-known exit strategy and turned it into a large-scale fraud.

Owners looking to transfer or exit a timeshare should verify the legitimacy of any company making offers, avoid paying large upfront sums without documented proof, and seek independent legal or financial advice.

If an offer sounds too good to be true or involves high-pressure sales, stay cautious. Always check the credentials and registration status of the firm, retain payment records, and monitor your accounts for unexpected liabilities.